Credit Union Cheyenne WY: Personalized Banking Services for You

Credit Union Cheyenne WY: Personalized Banking Services for You

Blog Article

Credit Rating Unions: Your Gateway to Financial Well-Being

Lending institution have actually become a vital channel to monetary stability, offering a host of advantages that conventional banks might not give. From individualized interest to affordable prices, they satisfy the individual requirements of their members, fostering a sense of community and count on that is usually lacking in bigger financial organizations (Cheyenne Credit Unions). The concern continues to be: just how do lending institution accomplish this unique balance of individualized service and economic advantages, and what establishes them apart in the world of monetary health?

Advantages of Signing Up With a Lending Institution

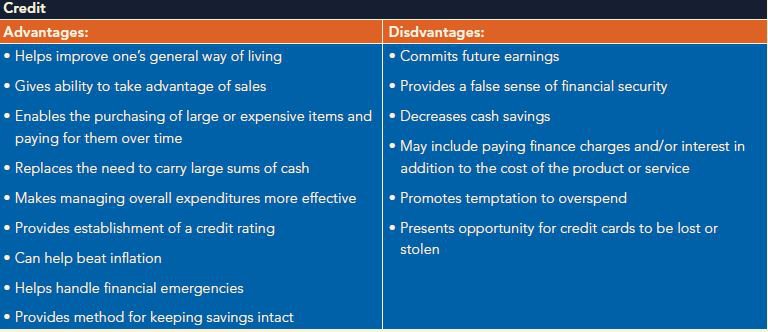

Credit history unions provide a range of benefits that can boost individuals' monetary health. In addition, credit scores unions usually provide economic education and learning and counseling to assist participants enhance their monetary proficiency and make much better choices concerning their money management.

In addition, by signing up with a lending institution, people enter into a community that shares comparable economic goals and worths. This feeling of belonging fosters count on and loyalty amongst members, producing a supportive atmosphere for attaining financial success. Credit unions are recognized for their dedication to regional neighborhoods, usually reinvesting profits into area growth campaigns. By lining up with a credit union, people not only enhance their own monetary health however also add to the economic growth and success of their area.

Personalized Financial Solutions

When looking for tailored financial remedies, participants of cooperative credit union can take advantage of personalized advice and services made to meet their unique requirements and goals. Cooperative credit union prioritize comprehending their members' monetary circumstances, goals, and constraints to provide personalized remedies that conventional banks could not provide. This tailored method permits cooperative credit union members to access a series of economic items and services that provide especially to their specific situations.

Cooperative credit union use individualized financial remedies such as tailored budgeting strategies, investment strategies, and funding options tailored to participants' credit rating and monetary histories. By working very closely with their participants, lending institution can offer recommendations on how to improve credit report, conserve for details goals, or navigate economic difficulties. Additionally, credit score unions usually offer financial education and learning sources to empower members to make enlightened decisions concerning their money administration. Overall, the customized touch offered by credit score unions can help members achieve their financial goals effectively and effectively.

Reduced Charges and Competitive Rates

In the realm of economic solutions, credit rating unions set themselves apart by offering members lower costs and competitive rates contrasted to traditional financial institutions. One of the crucial benefits of credit rating unions is their not-for-profit structure, which enables them to focus on the economic wellness of their participants over maximizing revenues.

Furthermore, lending institution usually offer more affordable passion prices on interest-bearing accounts, certificates of down payment, and finances. By maintaining lower operating prices and concentrating on serving their members, credit scores unions can hand down the advantages in the kind of greater rates of interest on cost savings and reduced rate of interest on car loans. This can assist participants expand their savings faster and pay much less in passion when borrowing cash, ultimately adding to their overall economic wellness.

Community Focus and Customer Care

With a strong emphasis on area emphasis and outstanding customer care, credit score unions distinguish themselves in the monetary services sector. Unlike standard banks, cooperative credit union prioritize building solid partnerships within the neighborhoods they offer. This community-centric strategy allows lending institution to better comprehend the unique financial needs of their participants and customize their services appropriately.

Customer support is a leading priority for credit unions, as they make every effort to supply individualized help to every participant. By using a much more human-centered method to banking, credit rating unions develop a welcoming and supportive environment for their participants. Whether it's aiding a member with a car loan application or providing financial advice, lending institution staff are recognized for their alert and caring solution.

Achieving Financial Goals

To enhance monetary well-being, lending institution help Credit Union Cheyenne members in attaining their economic objectives with customized assistance and tailored monetary remedies. Credit rating unions understand that each member has one-of-a-kind economic aspirations and challenges, and they are devoted to helping individuals browse their financial trip successfully.

One way cooperative credit union sustain participants in achieving their monetary goals is by using monetary education and learning and resources. Via workshops, seminars, and individually appointments, lending institution staff supply beneficial insights on budgeting, conserving, investing, and taking care of debt. By equipping members with the needed knowledge and skills, credit history unions equip individuals to make educated economic choices that align with their goals.

Additionally, cooperative credit union provide a wide variety of monetary services and products to help members reach their certain objectives. Whether it's acquiring a home loan, setting up a retired life account, or beginning a college fund, lending institution supply tailored options that provide to members' one-of-a-kind needs. By functioning very closely with each member, credit score unions ensure that the economic services and products suggested are in line with their lasting and temporary economic goals.

Final Thought

In final thought, lending institution supply a portal to financial health with individualized focus, customized economic solutions, reduced fees, and competitive prices. As member-owned cooperatives, they focus on the demands of their participants and offer far better interest rates on cost savings accounts and lower finance rates. With a community focus and commitment to client service, lending institution aim to understand their participants' one-of-a-kind economic scenarios and goals, supplying individualized assistance and assistance to help individuals achieve their monetary objectives.

Credit rating unions provide customized monetary remedies such as personalized budgeting plans, financial investment techniques, and car loan alternatives customized to members' credit history ratings and monetary histories.One means credit rating unions support participants in attaining their economic goals is by providing economic education and sources. By working very closely with each member, debt unions make sure that the financial products and services recommended are in line with their long-term and short-term monetary goals.

With a neighborhood emphasis and commitment to client service, credit unions strive to recognize their participants' one-of-a-kind monetary circumstances and objectives, providing customized assistance and support to assist people accomplish their economic purposes.

Report this page